virginia tesla tax credit

Local Virginia and Maryland Electric Vehicle Tax Credits and Rebates. Tesla to get access to 7000 tax credit on 400000 more electric cars in the US with new incentive reform.

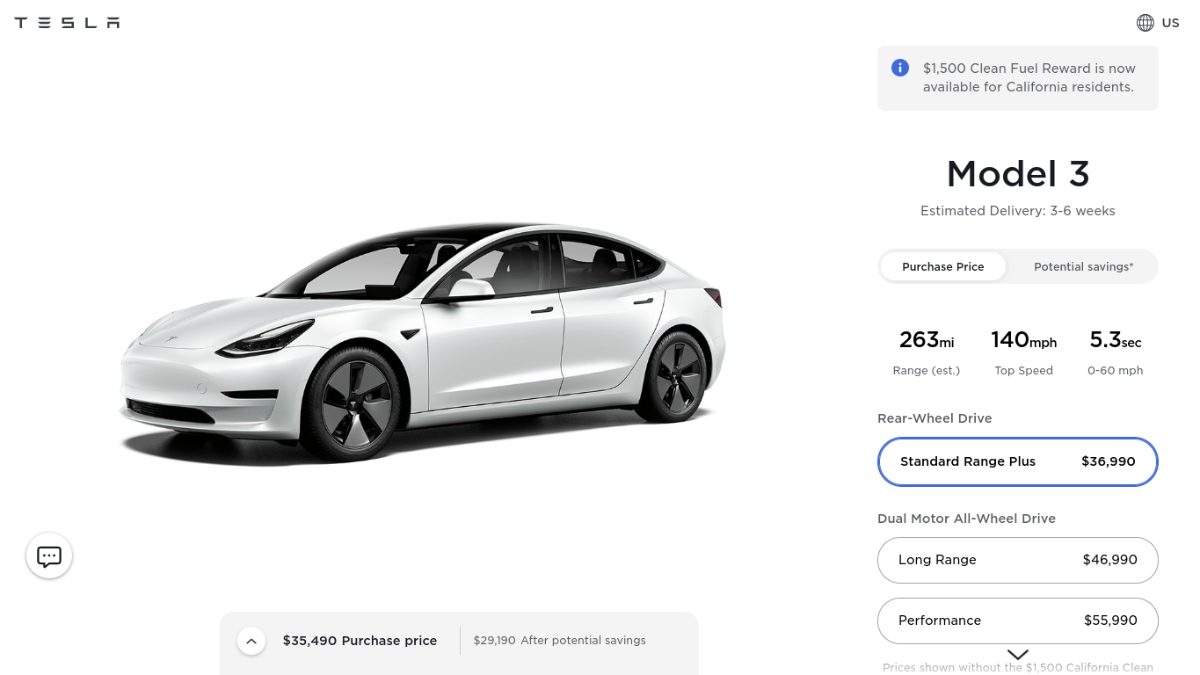

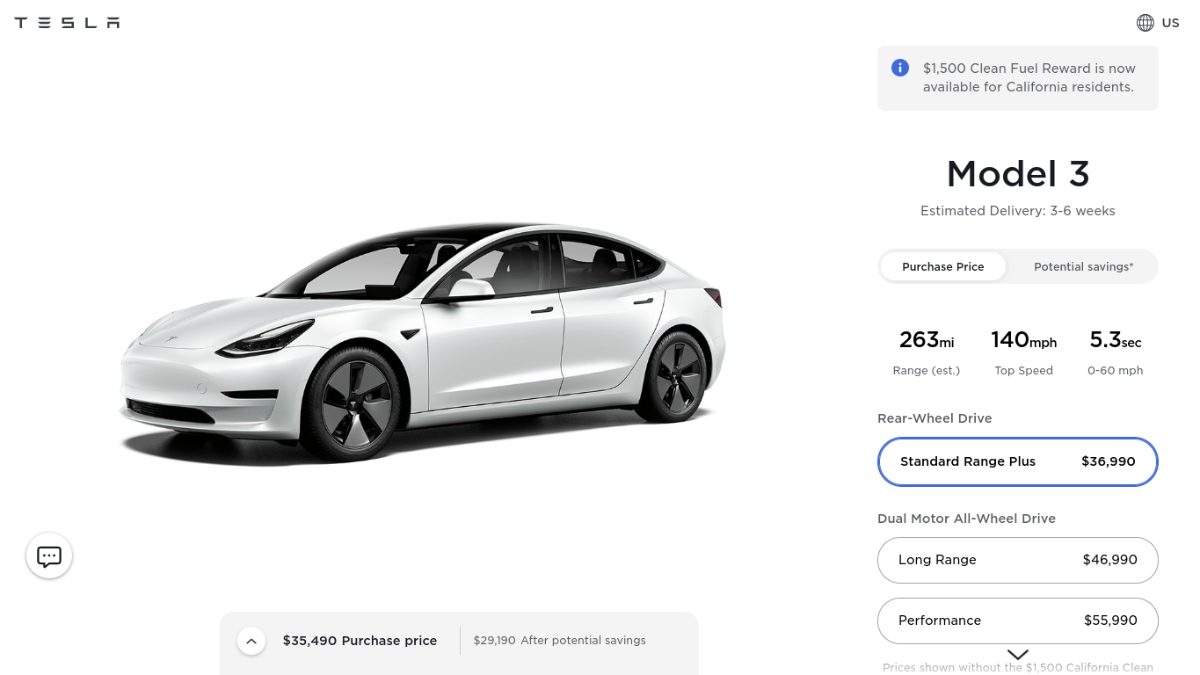

Latest On Tesla Ev Tax Credit March 2022

Carry forward any unused credits for 5 years.

. 2500 tax credit for purchase of a new vehicle. Review the credits below to see what you may be able to deduct from the tax you owe. First the amount you receive will depend upon your vehicles gross weight and battery capacity and your EV must have at least five kilowatt-hours of capacity and use an.

The federal tax credit falls to 22 at the end of 2022. If for example you buy your new ev in june 2020 youll apply. Im a Model 3 owner in FL but recently received a job offer in NoVA and am seriously considering it.

The base amount of 4000 plus 3500 if the battery pack is at least 40 kilowatt-hours remains the same. Virginia entices locals to go green by offering numerous time- and money-saving green driver incentivesThese perks include alternative fuel vehicle AFV emissions test exemptions for electric cars and hybrids high occupancy vehicle HOV lane access for clean-fuel vehicles state and federal tax incentives discounted electric vehicle EV charging rates fuel-efficient auto. However you should be aware of the following requirements.

The Build Back Better bill will increase the current electric car tax credit from 7500 to 12500 for qualifying vehicles. HB 717 proposes that an individual who buys or leases a new or used electric vehicle from a dealer in Virginia and registers the vehicle in Virginia would be eligible for a rebate. The legislation will be introduced when the Virginia General Assembly convenes on January 13 2021.

Cap is 6 million per year. 11th 2021 622 am PT. If the purchaser of an EV has an income that doesnt exceed 300.

I recently learned of the annual vehicle tax in VA but the calculation of it is a bit ambiguous in regards to the vehicle value they base it on. This includes US automakers like Tesla who topped over 200000 qualified plug-in electrics sold a few years ago and as a result no longer qualifies for any federal tax. A bill proposed in mid-January by Virginia House Delegate David A.

TSD-110 WEST VIRGINIA TAX CREDITS Page 1 of 21. HB 1979 proposes that an individual who buys or leases a new or used electric motor vehicle from a dealer in Virginia and registers the vehicle in Virginia would be eligible for a 2500 rebate. Dont forget about federal solar incentives.

The purpose of this publication is to provide a brief overview of West Virginias current tax credits. Can this whole bill Bidens proposal though comes with an anti-Tesla twist. With the Investment Tax Credit ITC you can reduce the cost of your PV solar energy system by 26 percent.

President Bidens EV tax credit builds on top of the existing federal EV incentive. Used Vehicles Would Qualify. The legislation will be formally introduced when the Virginia General Assembly convenes on Wednesday January 8 in Richmond.

To learn more about the Land Preservation Tax Credit see our Land Preservation Tax Credit page. Keep in mind that the ITC applies only to those who buy their PV system outright either with a cash purchase or solar loan and that you must have enough. If you install your photovoltaic system in 2020 the federal tax credit is 26 of the cost of your solar panel system.

A 500 income tax credit for each new green job created. Select utilities may offer a solar incentive filed on behalf of the customer. The federal solar tax credit.

It sounds like if approved the bill would give a 10 State tax credit up to 3500 on the purchase of a BEV not a plug-in Hybrid effective January 1st 2018 for the next 5 years or until EVs are 20 of the new vehicles sold. The Virginia General Assembly approved HB 1979 which provides a 2500 rebate for the purchase of a new or used electric vehicle. Reid D-32nd would have granted a state-tax rebate of up to 3500.

An additional 2000. In addition to credits Virginia offers a number of deductions and subtractions from income that may help reduce your tax liability. Consumers would be eligible for an extra 4500 if.

1500 tax credit for lease of a new vehicle. Tesla and GM are set to. TSD-110 Revised February 2022 WEST VIRGINIA TAX CREDITS.

Consumers would be eligible for an extra 4500 if. The MSRP for new vehicles and. Tesla hit the limit on the original EV tax credit in 2018.

Hello Virginia Tesla Model 3 owners. Tesla hit the limit on the original EV tax credit in 2018. Theres good news on the local front on electric vehicle tax incentives and rebates in Virginia.

Tesla buyers in us can access a 7000 tax credit for the purchase of another 400000 evs thanks to the growing renewable energy and efficiency now green act 2021. You claim the credit the same year that you create the job then each of the next 4 years so long as the job remains continuously filled. Virginia Governor Ralph Northam has signed a bill which will require car manufacturers to sell a certain percentage of electric or hybrid vehicles.

You can claim a credit for up to 350 new jobs. The credit claimed cant exceed your tax liability. This is 26 off the entire cost of the system including equipment labor and permitting.

Used Vehicles Would Qualify. If your solar energy system costs 20000 your federal solar tax credit would be 20000 x 26 5200. You get a 7500 tax credit so that also.

This credit may range from 2500 to 7500 and is intended to make it more affordable to manage the up-front costs of these vehicles. The qualified plug-in electric drive motor vehicle credit is a nonrefundable federal tax credit of up to 7500 according to Jackie Perlman. Can This Whole Bill Bidens proposal though comes with an anti-Tesla twist.

Tax Credit For Electric Cars Tax Credits Online Taxes Irs Taxes

Tesla S Electric Cars Could Regain Federal Tax Credit Carsdirect

Electric Vehicle Sales Enjoy Boost In Areas Of Minnesota Twin Cities

A Bigger Tax Credit For Going Electric What It Could Mean For Consumers Forbes Wheels

Joe Biden Wants To Give A 7 500 Tax Credit To Anyone Buying An Electric Vehicle Forever National Review

Updated 17 States Now Charge Fees For Electric Vehicles Greentech Media

Electric Vehicle Buying Guide Kelley Blue Book

Tesla S Fremont Car Plant Was Most Productive In North America In 2021 Report

Maryland Ev Tax Credit Extension Proposed In Clean Cars Act Of 2021 Pluginsites

Will The Blue Sweep Boost Tesla Don T Count On It The Motley Fool

Tesla Model 3 2022 Updates Yaa

Used Tesla For Sale Online Carvana

The Red Tesla Model S Electric Luxury Sedan Showing At The 2013 Detroit Auto Show Has A Nearly Six Figure Sticker Price Including Tesla Motors Tesla Suv Tesla

Latest On Tesla Ev Tax Credit March 2022

Will Tesla Gm And Nissan Get A Second Shot At Ev Tax Credits Extremetech

Tesla Cuts Model 3 Y Prices As New Federal Tax Rebate Makes Customers Delay Their Purchases Torque News

Tesla S 7 500 Tax Credit Goes Poof But Buyers May Benefit Wired